Our application for the 22/23 school year is now open. Apply HERE. This application will remain open until late May 2023.

We currently offer 3 convenient ways to apply for scholarships.

- Online. You will start by creating an online profile so that you can save progress and revisit your applications. Apply online here.

- Apply-by-Phone. If you would prefer to have one of our team member assist you this process, you can make an appointment by clicking here. Please be prepared to provide the gross income for each member of your household matching the previous year’s tax filing.

- Download a paper application. Once completed, you can mail to:

11445 E Via Linda #2-145

Scottsdale AZ, 85259

Or scan and email to: applications@arizonatuitionconnection.comDownload paper copy here.

Absolutely not.

No matter a family’s income, anyone who has a child attending K-12 private school in Arizona should take advantage of this tax scholarship program.

Arizona Tuition Connection does not have some of the income caps other School Tuition Organizations operate under, so even if your family is blessed with a higher income there are scholarship funds available.

You should especially apply if your child is in kindergarten or transferring from a public school, homeschool program, or out-of-state school to an Arizona private school. There are “Switcher” scholarships available if you apply your first year in private school. A student must receive a Switcher scholarship their first year in private school to continue to receive them in future years. It is so important you don’t miss this opportunity. If your child does not receive a switcher scholarship their first year, your child might not ever be eligible to receive them again.

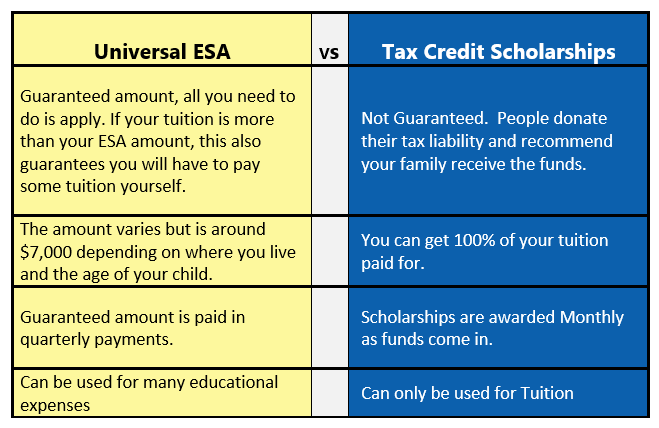

- You cannot take ESA funding and Tax Credit Scholarships at the same time.

- Parents, it is not the school’s or School Tuitions organization’s responsibility to make certain you don’t take both at the same time, so please keep us informed.

- You CAN continue to get tax credit donations for your family while you are on an ESA, contract. We can hold those funds until it makes sense for you to move your child off ESA and over to tax credits.

Who should take Universal ESA?

If you attend a school where tuition is less than your ESA guaranteed amount. Use the Universal ESA Program. Still get tax credit donations, as we can award, but hold funds, until you will need them in high school.

If you are just starting with the private school tax credit program. Take ESA funding until it makes sense for you to move over to tax credit scholarships. Move away from ESA once you had more tax credit scholarships being held for your family.

Who should not take Universal ESA?

If you already have more donations/awards coming in than your ESA amount. It does not make sense to take ESA if you can get more in Tax Credit Awards.

If you are low-income corporate scholarship eligible. In this case apply to multiple School Tuition Organizations and take corporate funding.

No matter what your strategy, you should not stop getting tax credit donations where your family is recommended to receive those funds. At some point in the future, you will be able to use them.

How long can Arizona Tuition Connection Hold funds that have been donated while a student is on ESA

Once your child is in Kindergarten, Arizona Tuition Connection will be able to allocate those funds to your child and hold them. We will award them to the school once you cancel your ESA contract. There are two requirements to do this:

1.) Your child must remain enrolled in an AZ private school. If your child goes to a public, charter or home school, the funds are lost.

2.) You must maintain an active application with Arizona Tuition Connection. The law requires an application for every student, every year.

Learn the details

Arizona Tuition Connection offers coaching sessions to teach parents how this process works and develop a specific strategy for your family. A list of these sessions can be found at www.arizonatuitionconnection.com/events

This is the perfect time to plan ahead! If you have a child that will start attending private school for the first time in an upcoming school year (typically either kindergarten or 9th grade). Individuals can donate and recommend your student to receive those funds the year before attending private school. Awards will be held until your child is enrolled and we have received a completed application for that year. In the meantime, you can complete a Private School Registration Form and return it to us.

For personalized donation brochures, email marketing@arizonatuitionconnection.com, and plan to attend a coaching session!

There are 4 scholarships available through this tax credit program. Although many students are not eligible to receive every scholarship we offer, any student enrolled in private school in Arizona can receive funding from at least one of the scholarships. So, any student can get a significant portion or even all of their tuition covered.

The one exception is if you are taking Empowerment scholarships. By law no student can accept both ESA and tax credit scholarship awards at the same time. If you do this you will be required to return the money to one of the organizations who granted the scholarship awards. More information about empowerment scholarships can be found at www.azed.gov/esa.

We don’t have any application deadlines. State law requires a new scholarship application for each school year for each student.

Bottom line – it is never too late to apply.

There are currently four types of scholarships that Arizona Tuition Connection provides, each of which are funded by three different tax credits: (At this time we do not have the 4th scholarship, called disabled / displace, available.)

1) The Original tax credit Scholarship. – There are some general guidelines by the state for these scholarships, but essentially all K-12 children attending a qualified private school can receive Original Scholarships.

2) The Switcher (Overflow/PLUS) tax credit scholarship. – The state has set some very specific award guidelines to receive this type of scholarship.

– Enrolling in or currently enrolled in a private school kindergarten, OR

– Attended an Arizona public school, full time, for at least 90 days of the prior fiscal year and then transferred to a private school, OR

– Are transferring from an out-of-state school, OR

– Attended a homeschool program in the previous year, OR

– Were previously receiving ESA funds, and have discontinued the ESA program, OR

– Received a switcher scholarship in a prior school year and remained in private school in subsequent years, OR

– Received a low-income corporate scholarship or disabled/displaced scholarship in a prior year and continued to attend private school in subsequent years.

3) The Corporate Low-Income tax credit scholarship. – There is an income cap, plus other requirements to receive low-income corporate scholarships.

– Family income must be below the numbers indicated in the chart below AND meet one of the following:

– Enrolling in or currently enrolled in a private school kindergarten, OR

– Attended a Arizona public school, full time, for at least 90 days of the prior fiscal year and then transferred to a private school, OR

– Received a switcher scholarship in a prior school year and remained in private school in subsequent years, OR

– Received a low-income corporate, switcher or original scholarship in a prior year and continued to attend private school in subsequent years.

Household Size Income level

1 $49,900

2 $67,492

3 $85,083

4 $102,675

5 $120,267

6 $137,858

7 $155,450

8 $173,042

Each additional $17,592

Once you apply you will receive an email confirmation of which type of scholarships your child is eligible to receive. It is important for you to understand what type of scholarships your child is eligible for, to make certain you receive all possible awards.

We will do that for you. Simply fill out our application completely.

Once we receive your application our customer service team will determine which scholarships state laws will allow your child to receive. There may be some additional information we request from you, so please read our follow up email communications carefully.

Our goal is to award scholarships out monthly.

About a week after we award scholarships to the school, we send the parents an email with the details of the scholarship award.

We encourage all families to educate themselves, use the tools we offer, and ask their social contacts to donate and recommend those funds to their family. It is not a good strategy for parents to expect scholarships other than from those that have been recommended to their family.

It is important for parents to understand how the award process works, as not every child is eligible for every type of scholarship.

The first thing parents must understand is how donations are categorized.

Many of the donations we receive come with a student recommendation. Although the law prevents us from using that recommendation as the ONLY criteria for awarding scholarships, Arizona Tuition Connection uses it as one of the primary criteria for determining who receives awards.

When donations are received from individuals, Arizona Tuition Connection must categorize those donations as available to be used for two different types of scholarships. For donations coming in from married couples for the 2022 tax year, the first $1,245 of each donation must be used for Original Scholarship Awards. Any amount over $1,245 (up to an additional $1,238) must be used for Switcher Scholarships. For singles who donate, the first $623 must be used for Original Scholarship awards, with any amount over (up to an additional $620) going towards Switcher scholarships.

For example: If we receive a donation for $2,000 in the 2022 tax year from a married couple, $1,245 will be available for Original scholarships and $755 will be available for Switcher scholarships.

The next thing for parents to understand is what type of scholarship awards their child is eligible for – Original, or both Original and Switcher. This information is part of a previous FAQ question in this section.

If your child is not switcher eligible, we cannot award your child a switcher scholarship even if your child has been recommended to receive those funds. If your child is switcher eligible, then they would be eligible for scholarships from both original and switcher parts of the donation.

Switcher funds that cannot be used by your family will be used to support other families at your school.

Awards from funds that come in with no recommendation:

When donations come in with no recommendation, criteria such as the relationship we have with the school, income of the family, and recommendations from the school are the primary considerations we use when awarding scholarships. Other considerations also come into play.

Awards from funds where your school was recommended:

Sometimes funds are donated and a specific school is recommended. Arizona Tuition Connection will award those funds to the applicants from that school with the primary considerations being family income and participation in the programs we offer.

Finally, it is important to understand that Arizona Tuition Connection has overhead costs. Our largest expenses are credit card fees and labor. Other primary expenses include printing, IT costs, and mileage. By law at least 90% of the donations must be used for scholarship awards. Up to 10% of donations may be used to cover overhead expenses.

It sounds like a basic thing, but filling out the application completely is the first step in maximizing your family’s opportunity to receive a scholarship. If the application is not filled out completely you may not receive any funding, or you may receive less funding that you otherwise could.

The best way you can maximize the scholarship donations for your child is to ask your friends and acquaintances to donate their tax dollars and recommend your child. Although state laws say Arizona Tuition Connection cannot use the recommendations of donors as the only factor when awarding scholarships, we can use it as one of the factors. The more money we receive in donations, the more money we have to award in scholarships.

Additionally, many employers offer donation matching to nonprofit organizations. Once a friend or acquaintance donates, ask them to inquire to their HR department about matching gift opportunities.

For the 2022 tax year, the maximums are $2,483 (married) and $1,243 (single). With these high donation amounts, it does not take long to make a significant impact in your tuition expenditures.

Another opportunity to maximize your scholarships is to see if the company you work for would consider donating. There are laws surrounding these types of donations, but millions of dollars are donated every year with corporate tax credits. Please call us to discuss if you feel your corporation might be interested in donating.

Finally, participate in the programs we offer. You will start receiving a series of emails from us, with ideas and suggestions. We have seen that the families who try these ideas have significantly more money donated in their children’s names.

- Do you have brochures ready to hand out?

- Do you have your donation page ready?

- Is your donation page shared on Facebook?

- Are you familiar with how the tax credit process works?

- Have you made a list of people you will specifically ask to donate?

State law does not allow us to share the names of any of the donors. We must abide by that law.

We are allowed to share the total dollars that have been donated and recommended to your family. The easiest way to do this is to send us an email at info@arizonatuitionconnection.com and ask us to provide you that information. Please be certain to provide us the name of your child in your email.

To be successful at a minimum you need to be able to explain the following:

1. The difference between a Tax Credit and a Tax Deduction. When someone makes a donation to any non-profit it can be taken as a federal tax deduction. That means it lowers their taxable income by the amount that is donated. So if someone has an income of $50,000 a year and they donate $3,000 to a non-profit, they only get taxed on $47,000. Contributions to this program are a Tax Credit. A tax credit is much better than a tax deduction. A tax credit is a reduction of a persons actual taxes. So that same person with an income of $50,000 probably has a tax liability of around $1,000. If they contribute $750 to this program, they take a dollar-for-dollar tax credit (reduction) off of state tax liability. They will be paying $750 to this program, and $250 to the state.

2. How much a donor can donate. For the tax year 2022, the maximum a married couple filing jointly can donate is $2,483, and $1,243 for a single person.

3. The donation deadlines. – Your donors have until April 15th, 2023 to donate and take it off 2022 taxes.

Common Concerns from potential donors and possible responses:

Q. I don’t pay taxes, I get a refund.

A. Although some people who are employed don’t have to pay taxes, most people with a job do. Participating in this program has nothing to do with if they are getting a refund or if they owe taxes when they file their return. It has to do with if they have a tax liability. This program lowers your tax liability.

Q. Is this the same as the Public School Tax Credit of $400.00?

A. No, they are totally separate programs. Actually, the state offers many different tax credits. Residents can participate in them all.

Don’t give up. You may have to ask 20 different people to donate, before one says yes. But it is worth it. Donors tend to donate to the same family every year. So each new donor added can mean multiple years of scholarship awards.

Here are some more things to consider:

1. Educate yourself and develop talking points you are comfortable with.

Attend one of our coaching sessions. A list of sessions can be found on the home page of our website. We can’t stress enough how important being educated on this program is.

You should be able to explain how the tax credit program works, what a tax credit is and how donors get their money back when they file their returns.

Common talking points often center around:

- It costs you nothing to donate because it is a tax credit donation.

- You are going to be paying the money to someone, either the state of Arizona or our family – This helps our family.

2. Be intentional.

-

- Make a list of people you know who are employed in Arizona, and establish a plan to contact them.

3. Use our free tools.

Create donation pages and personalized brochures to help get donations. These tools are an excellent way to start a conversation with potential donors. To get started send a picture of your child to marketing@arizonatuitionconnection.com. For more information, visit our personalized tools page.

4. Carry donation forms with you.

-

- You never know when you will meet someone who can donate. Pre-fill them out as much as you can to make them easy for your donors.

5. Participate in the other programs we offer.

-

- You will start to receive regular email communications of “tips and tricks” and programs that have been successful. The more you can participate in these programs, the more funds will be available for scholarships.

6. We are here to help.

Much of our staff are parents with kids in private schools who are now experiencing success in receiving donations. We have been in your shoes and we are here to help. Call us before you get frustrated, and let’s talk things through.

If you have an Arizona tax liability – this is an Arizona State tax credit.

If you don’t have an Arizona State tax liability, your donation might be a tax deduction off your federal taxes. Arizona Tuition Connection is a 501(c)3 nonprofit organization. Please consult with your tax advisor regarding federal deductions.

The state tax credit law allows donors to recommend a student or school for a tuition scholarship. The recommendation of the donor is our top criteria when awarding scholarships, but the law does require us to take other criteria into account.

State law requires that certain amounts from each donation be used for different types of scholarships. It is important to understand that not every student is eligible to receive every type of scholarship available.

Please contact us if you have any questions on this.

- For the 2022 tax year, the maximums are:

$2,483 married filing jointly, and

$1,243 filing single.

Your tax liability is not what you owe when you file your taxes but is the total amount you would owe if you had not paid any taxes all year long. The best way to determine your tax liability is to talk to your tax advisor. If you don’t have a tax advisor, it is common for people to look at what their tax liability was in previous years. Your tax liability can be found on line 48 of your AZ 140 form. If your income is the same as the previous year, this might give you an indication of what your liability is this year.

CLICK HERE to calculate your tax liability using a free online tax calculator.

*By using the link above, be please advised that the linked site has been created, published, and maintained by parties independent of this organization. We do not assume responsibility for the accuracy of the information contained therein.

Absolutely! Arizona offers several tax credits (Public School, Veterans, Qualified Charitable Organizations, Qualified Foster Care Organizations) in addition to the Private School tax credit. You can donate to them all, up to your tax liability. So, go ahead and support the causes you love. If you like, you can go to AZTAXCREDITFUNDS.COM to make all of your tax credit donations.

For the 2022 Arizona tax credit, donations can be accepted through April 15th, 2023.

Even if you are filing an extension, your donation must be received by the date above.

The information you need to claim the credit will be provided to you on your receipt once you complete your donation.

Depending on how much you donate, your donation may be split into two parts on your receipt.

- Credit for Contributions to Private School Tuition Organizations (Original Individual Income Tax Credit) This tax credit is claimed on Form 323.

For tax year 2022, the maximum credit allowed is $623 for single, and $1,245 for married filing joint. - Credit for Contributions to Certified School Tuition Organizations (Switcher Individual Income Tax Credit) This tax credit is claimed on Form 348 and is available to taxpayers who donate more than the maximum amounts that can be taken on Form 323. For tax year 2022, the maximum credit allowed is $620 for single, and $1,238 for married filing joint.

These two forms are then summarized on Form 301. All forms are available from the Arizona Department of Revenue (ADOR) at www.azdor.gov, or from your accountant or tax software.

Not all students are eligible to receive Switcher tax credit scholarships. If you have questions about if a child is eligible for Switcher scholarships, please contact the families prior to making your donation.

We have created a tips and tricks guide for TurboTax that will help you through the process of claiming your private school tax credit donation.

No, the law states you cannot donate to your own household.

No. The law states, “A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent.”

Yes, state law requires that we collect a minimum amount of information with each donation.

This is an Arizona tax credit program. To be able to take the donation as a dollar-for-dollar tax credit the donor must have an Arizona tax liability and be filing an Arizona tax return. People with no income in Arizona don’t file Arizona taxes and therefore don’t have any liability to take the credit against.

With that said, Arizona Tuition Connection is a 501(c)3 nonprofit organization. If people out of state would like to support your family, they can make a donation. Instead of being a dollar-for-dollar tax credit, these out-of-state donations may be eligible to be taken as a federal tax deduction. Donors claim it on their federal tax forms just like they do every other charitable donation they make. Please keep in mind tax laws have recently changed. We would strongly encourage discussing all such donations with a tax professional prior to donating.

Non-tax credit donations are not limited to the maximums set by the state for tax credit.

For questions regarding your federal deductions we encourage you to check with your tax professional.

The rules for what can and can’t be matched are established by your employer, but it is rare to see an employer not consider this a qualified donation.

For you to take it as a tax credit it is important that you do the initial donation correctly. According to Arizona state law, the original donation must be made directly to Arizona Tuition Connection or through an employer with holding, with the employer paying the withholdings directly to us.

You cannot make your original donation through United Way, Benevity, or a similar “umbrella” organization and take it as a tax credit. While we can certainly accept such donations, the donors are not entitled to take the private school tuition organization credit. The law states that the donor must make the contribution directly to a school tuition organization.

What you must do is make your donation directly to Arizona Tuition Connection, or through payroll deduction, then take the receipt we provide to the third party or your employer for matching. By doing it this way, you can take the credit and have your employer match.

Typically, your employer will send us some paperwork to complete and return. These matching funds can sometimes take a while to be sent. It is not uncommon for employers to cut matching checks quarterly or even semi-annually.

Not sure if your company offers a matching program? We can help! CLICK HERE to type in your employer’s name and see if they are listed.

The answer to this question depends on your family’s current situation.

1. If your child is going into a private school for the first time in the 23/24 school year. (Most often this is as a kindergartener or freshman, but it can be at any grade.)

We would ask that you fill out a registration form now, then when we are ready for you to apply for the 23/24 school year we will send you a renewal application. This registration form lets us know who you are, so you can get donations this tax season which will be applied to your tuition in 23/24.

STUDENT-REGISTRATION

2. Your child is currently enrolled in a K-12 private school and already has an application with Arizona Tuition Connection.

We will send you a 23/24 application by email when we are ready for you to apply. We start this in late February and continue through April. Watch for it in your email. Simply complete and return this form to us once you receive it.

Your child is currently enrolled in a K-12 private school and you do not have an application with Arizona Tuition Connection.

Apply for the 22/23 school year HERE. Our application is open until early May 2023.

Until May 15th 2023, the only application we will have available on our site is a 22/23 application.